Optionality Magic

Everyone loves having options — until they paralyze you. Making use of ambiguity without getting lost.

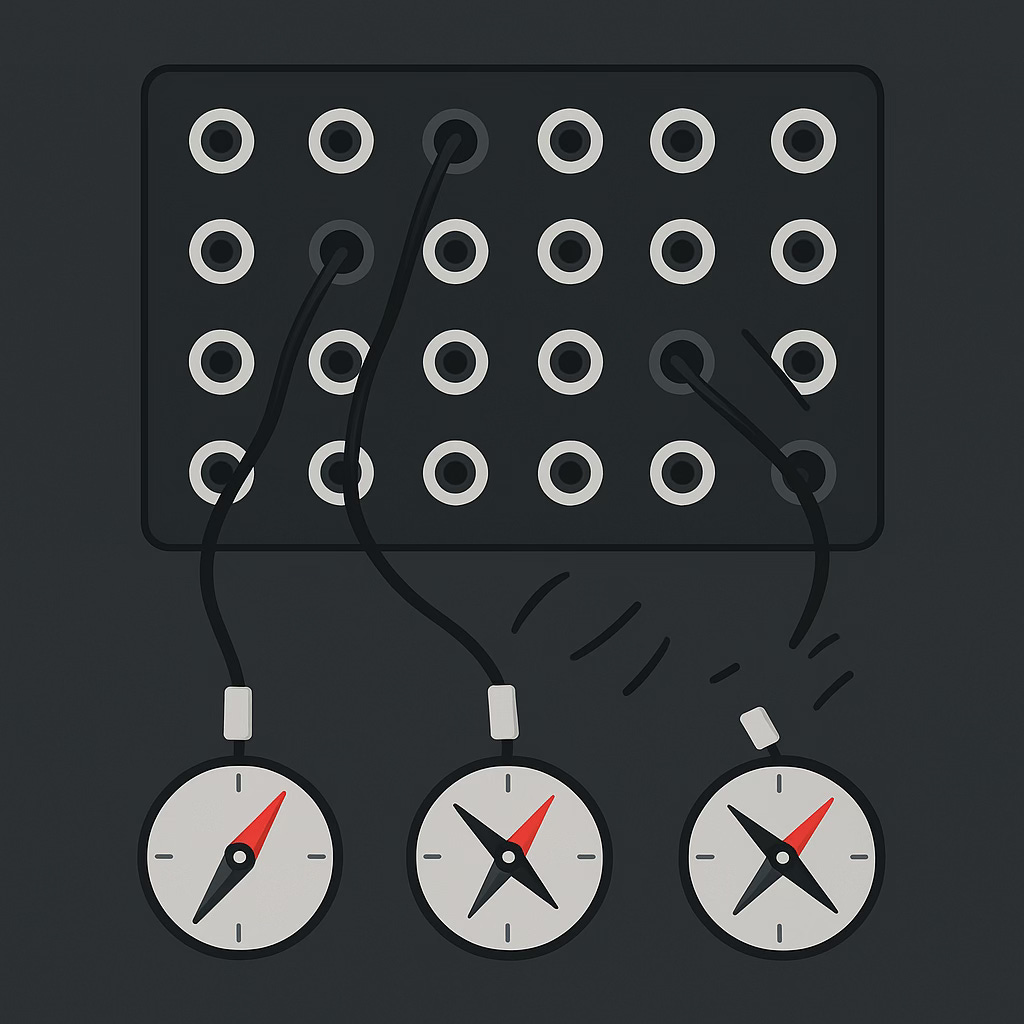

We often talk about strategy as a single big decision. But our friend up there, on his journey, while chasing one direction (intent) had to come up with a lot of decisions on his way to make it to his intended target. He did not know he had to make these decisions upfront. For that he had to chose options. In hindsight it was easy. But in the situation, it looks messy. And the more uncertain we are, the ambiguous teh situation, the more we crave for certainty. We dive into metrics and build a scaffolding of certainty theatre, while the reality remains the same: uncertain. Things to chose, decisions to make. Our friends choices were not deterministic. they followed principles of optionality and that’s why in hindsight it looks like the perfect strategy. This article is trying to explain those principles.

Strategy and smart decisions are determined by how we handle options

It takes discipline and clarity to deal well with options . You’ll see why staying in intent — and thus, great strategy — isn’t about finding the perfect choice, but about choosing a good-enough option that’s in the right direction

It’s also a setup for a future post, where I’ll introduce a more complete structure — a way to think about strategy that connects identity, optionality, and execution in one intentional system.

But for the moment take this away: The maturity of a company is defined by the way it actively shapes its optionality.

The classic Startup Downfall: Wrong, tempting option chosen

Here’s an example of a tempting, great-looking option that has already pulled startups off their intended trajectory.

Most startups struggle to get their first clients — and enough clients — on board. Along comes a big client. The issue is: big client not only has big wads of $$$ but also lies outside the intended target group, the ideal customer profile (ICP).

The risk of following this client is manyfold:

They will dominate your roadmap.

You will live in fear of not meeting their needs.

They will realize they have this power over you.

In the end, it’s why they made the deal: they get exactly what they want.

Before you realize it, you’re no longer building a product for your market — you’re building custom software for one client. It feels safe and good for a few months. But eventually, you and your employees realize something’s off. What’s off is that you chose the wrong option.

And because of you chasing the wrong option, just like that, you are now in the wrong business: Your are not building a product any longer. (Although it feels like it and it’s easy to fool you into thinking you are doing the right thing.)

While it brought serious money, it kept you from doing your actual job: building a scalable product investors are waiting for. You chose an option that was not aligned with your intent or strategy — it just looked attractive financially. You did the wrong thing.

What’s the other classical Startup Downfall? Right: Too many options chosen. Again: Too much temptation, not enough discipline.

There will be more on options later — today, just some basics.

Options: What They Are and Why They Matter

In everyday life, we constantly face options — from deciding what to eat for dinner to choosing a career path. In its simplest form, an option is a choice or course of action that can be taken in a given situation.

But when we apply the concept of options to strategy, finance, or decision-making, it becomes more complex — mainly because the consequences of bigger decisions are far-reaching.

A fun story from Feynman:

At one stage of his career, he always went to a Mensa for lunch. For dessert, he could never decide between chocolate or vanilla pudding. Then one day, fed up with his own analysis paralysis, he decided that from now on, he would alwayshave vanilla.

It’s a silly story, but it’s a great example of how we can deal with options efficiently — or not. Especially when the difference in outcome is minimal.

Anyway.

A funny thing about options: while they represent possible paths or choices, they have zero value until one is actually chosen and executed. Until then, options are just work-in-progress (WIP). And considering too many options leads to overhead without value.

It sounds esoteric and obvious, but one of the most important things we can do is make explicit the difference between options that:

Simply float around,

Are actively discussed, and

Are committed to.

Why is this important?

Floating options shouldn’t concern too many people — they’re just noise until they gain shape.

Discussed options should be explored with purpose. We need to know who discusses them and for what goal.

Committed options require actual work and resource allocation — they’re real.

The Intentful View: How to Handle Options with Discipline

At Intentful, we see a core dialectic: being able to juggle many options while committing to very few. Embracing ambiguity by holding many possibilities in mind, while creating clarity by acting on only the ones that truly matter.

Another dialectic: We often try to choose the best option. But in practice, a good enough option — one with high upside and low downside — is all we need.

This doesn’t require perfect quantification. It requires qualitative sensemaking.

What’s more important than quantitative certainty is that the option points in the direction of our strategic intent.

If it does, we can benefit from compounding outcomes — many directional bets with low risk and high potential that add up over time.

It sounds almost too simple to be powerful — but that’s what great strategy often is.

Definitions from Different Fields

Everyday Life

A choice between alternatives. We evaluate, weigh pros and cons, and decide.

Finance

A contract giving the buyer the right — but not the obligation — to buy or sell an asset at a predetermined price before a certain date.

Key takeaway: Options allow flexibility. You gain time and information and can decide at a better moment.

Engineering / Project Management

An alternative solution path that could be chosen later depending on evolving circumstances.

Key takeaway: Options represent potential flexibility in complex systems.

In all cases, timing and uncertainty are key attributes. The value of an option lies in delaying commitment until more is known.

Real-World Examples: Strategy Through Options

Options help organizations navigate uncertainty — if used well:

Low Downside, High Upside: Look for options with a big reward potential and minimal risk.

Uncertain Cost/Value: Accept that you’ll never have perfect information. Sense when you know enough.

Cost of Overhead: Too many options = distraction and waste.

Real-World Example: Disney’s Acquisition of Marvel

Disney’s acquisition of Marvel in 2009 is a textbook example of a strategic option.

Marvel was financially unstable but owned a rich IP catalog. Disney lacked appeal to young male audiences and saw Marvel as a lever.

It wasn’t a short-term play — it was a bet on future strategic flexibility.

It gave Disney options to:

Develop standalone movies (Iron Man, Thor)

Create crossovers (Avengers)

Build a cinematic universe

The result? Over $22 billion in box office revenue — plus value from merchandise, parks, etc.

Disney didn’t have all answers in 2009. But the option was in the right direction, with low downside and massive upside.

eBay and M&A Options

At eBay, many acquisitions were handled with patience. They were seen as options rather than urgent value plays.

Example: buying a mobile.de-like company in Denmark. No immediate payoff was expected. But it opened up future synergy potential — which we later activated.

Even Skype was considered an option: maybe connecting buyers and sellers via video would boost trust. That option wasn’t taken. But the potential stayed.

Microsoft later bought Skype — and used it to build Teams.

Options Thinking: Lessons from Chris Matts & Olaf Maassen

Their real options theory (based on Black-Scholes) boils down to:

Options have value

Options expire

Never commit early unless you know why

Let’s add: Don’t commit if you don’t know why.

Optional (sic!): If you’re curious about the deeper math, explore the Black-Scholes formula. Just know: it’s a partial differential equation — not for the faint-hearted.

How to Decide: A Simple Options Framework

Identify Available Options

– Sketch paths and gather inputs.

Find the Last Responsible Moment

– Know when you must decide.

Delay Decision If Possible

– Use the time to learn and explore.

Keep Generating Options

– Until forced to decide.

Optimize for Direction, Not Perfection

– Choose what fits your intent.

Decide When Ready

– Don’t wait too long.

Act Fast and Decisively

– Once conditions align.

Summary: Why Options Thinking Is Powerful

Options create strategic flexibility — if we:

Filter and prioritize well

Align them with intent

Let go of irrelevant ones

The way a company handles options reveals everything: its maturity, direction, and ability to act under uncertainty.

Intentful companies don’t chase the best option.

They choose the right direction, consistently.

That’s how strategy compounds.

If you ever read about multi-year master plans: either they’re trivial (e.g. Tesla’s luxury-to-mass-market story) or post-hoc narratives. They connect successful option choices in hindsight, leaving out the failed ones — or keeping one in for drama.

Not cynical. Just complex systems in motion.

This is the paradox of strategic work: we hold many options, but act on few.

We delay commitments — but not direction.

We don’t need certainty — we need posture.

In the next parts of this series, I’ll zoom out to show how options fit into a model that helps organizations stay clear & adaptive

If you’ve ever struggled with too many priorities or wondered whether your work aligns with strategy — these posts will connect the dots.

"[Options] have zero value until one is actually chosen and executed."

I was all like "Chris Matts begs to differ" :D

And then he's been summoned anyway.

It's an important clarification. Having an option does have value. It's just that we realize that value once we execute an option.

Having a ticket to the space shuttle (an option) would have immense value if the planet were facing an unavoidable threat of annihilation. You could easily sell such a ticket for loads of money, I guess.

I think there's one point worth stressing here. Options have value. But, as you point out, there's a cost attached. Not only in purchasing/creating an option, but also maintaining it.

It's not necessarily true for a space shuttle ticket (or any other admission we purchase in real life). It is true in product development, though. Especially for startups. Even more so, for early-stage startups.

In theory, they can pursue so many directions. Even the Ideal Customer Profile, initially, is a broad category. Maintaining the perception that we do stuff for a broad audience comes at a cost of focus. And inefficiency because of higher work in progress and more context switching.